As feds focus on baseload, grid modernization is sweeping the nation

Posted by

admin on

Nov 15, 2017

As the Trump administration throws its weight behind legacy power assets, states and utilities are busy building the grid of the future.

The Department of Energy’s recent proposed rulemaking at the Federal Energy Regulatory Commission (FERC) would provide cost recovery to merchant coal and nuclear plants that keep 90 days of fuel supply onsite. The plan would provide support to many of the oldest generators in the country and observers worry it would unravel wholesale markets if enacted.

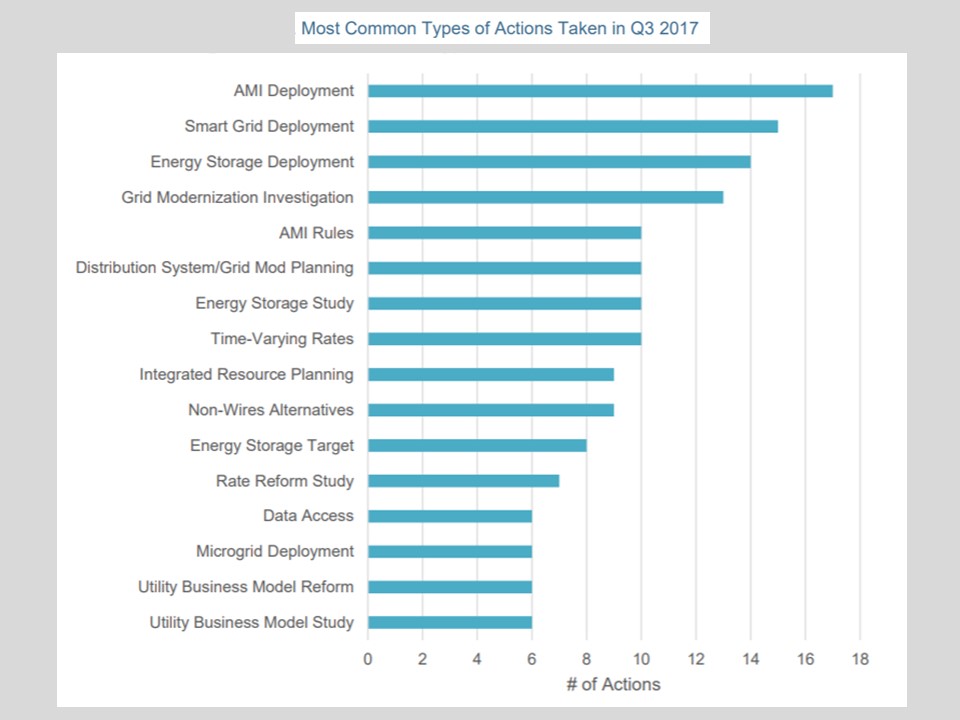

But the view from many states is much different. In the third quarter of 2017, there were 184 actions on grid modernization proposed, pending or enacted across 33 states and the District of Columbia, according to a new report. Those findings reflect an ongoing push for modernization nationwide. In Q2, there were 181 grid mod actions in 36 states, up from 148 actions in Q1.

Grid modernization actions make the power sector “more resilient, responsive, and interactive,” according to “50 States of Grid Modernization,” the new Q3 2017 policy update from the North Carolina Clean Energy Technology Center (NCCETC). “Actions” are legislation or regulation that addresses smart grid, advanced metering infrastructure, utility business model, or rate reforms, or ways to expand access to DER.

The clear trend this year has been in state-initiated investigations of grid modernization, said Autumn Proudlove, NCCETC Manager of Policy Research and lead author of the update.

“We are still at the beginning of grid modernization but more and more states are doing broad investigations to understand it better,” Proudlove said.

There were 40 actions to “tweak” existing policies and 38 actions to implement incipient programs or deploy “first-step” technologies in Q3, she said. But the real trend was in the 32 actions initiating studies or investigations on grid modernization, as well as 74 actions studying markets, planning, rate and business model reforms, and financial incentives, she added.

Also significant was the fact that 26 of the 33 states engaging with grid modernization “took actions on energy storage policies and deployment,” Proudlove said.

The emerging question asked by state investigations, Proudlove said, is what grid modernization should include enabling a 21st-century power sector?

The most common grid modernization action continues to be on advanced metering infrastructure (AMI), NCCETC reports. That is because AMI is a “foundational” infrastructure, Proudlove said.

Timothy Roughan, Director of Environment at Northeast utility National Grid, agreed with Proudlove.

“We see AMI as a foundational investment needed for time-varying rates, as well as better planning, operational, and storm restoration needs,” he said by email.

In Massachusetts, National Grid has had the benefit of one of the few completed state grid modernization investigations, Proudlove said. That is important because there are no widely accepted “best practices” for grid modernization, she added.

One of National Grid’s basic grid modernization premises is that DERs must be integrated into system planning and operations to enable customer-owned resources, Roughan said. Incentives and falling costs are also driving much higher DER penetrations, he said.

Without significant system investment in “new capabilities and equipment,” the underlying value of some of that DER will go untapped,” Roughan said. And without “a specific grid modernization plan with cost recovery” to deploy foundational technologies that enable DER would take “much longer,” he said.

In Missouri, Ameren began working in late 2016 for legislation to support its $1 billion, 5-year grid modernization proposal, Legislative and Regulatory Affairs Vice President Warren Wood told Utility Dive.

The traditional power system based on central station generation is evolving into “the integrated grid,” according to Ameren’s 2017 integrated resource plan (IRP). Higher penetrations of DERs, variable renewables and connected homes with smart meters and other communications technologies will require a “coordinated, bi-directional” grid to reliably balance distributed resources and customer demand.

Deployment of AMI and DER-enabling energy policies were “key objectives” of the Ameren-backed Senate Bill 190, which did not get through Missouri’s General Assembly this year, Wood said. The IRP objectives and the objectives of Ameren’s grid modernization plan are very much connected, he added.

Investments in grid modernization, along with constructive regulatory and energy policies, are “key enablers” for realizing the integrated grid’s benefits for Ameren customers, the IRP reported.

The successful deployment of AMI in Illinois proved grid modernization “is not a science fair project anymore and can deliver new customer options,” Wood said. “Missouri is behind other states. Moving forward on this is Ameren’s single highest priority there.”

Some stakeholders “do not see the benefit-cost advantage and are taking a prove-it-to-me attitude,” he added. “But we anticipate a benefit of about $2.40 from every dollar invested.”

Testimony on behalf of ReNew Missouri in a Missouri Public Service Commission proceeding investigating DER issues showed the utility and the advocacy group aligned in support of grid modernization. And Karl Rabago, executive director for the Pace Center for Climate and Energy Center, told the commission “comprehensive” utility planning for grid modernization is critical. It is the first step in “a deliberate shift in a utility’s approach to infrastructure, services, and engagement with customers and markets,” he said.

Grid modernization supports increased DER deployment and operation,” Rabago, a former Texas utilities commissioner, and DOE Deputy Assistant Secretary testified. That allows DER to become “a cost-effective alternative” and “empower customers to manage and reduce their energy costs.”

Ameren, Rabago and the Massachusetts investigation listed similar grid modernization objectives. They include reduced outage impacts, optimized demand and demand costs, the integration of DERs, and improved workforce and asset management.

Planning should emphasize the growth of renewables and DER, more intelligent and self-healing networks, and greater customer empowerment, Rabago argued. There should also be long-range, customer-focused planning and metrics to measure progress.

New technologies must be in place to give customers “new tools and better, more timely information based on real-time grid conditions,” he added. That kind of investment in customer-facing grid modernization allows customers to exercise their “desired degree of control over their energy use” and obtain benefits from “reductions in consumption and/or shifting consumption away from peak periods.”

Grid modernization policy actions are increasingly addressing DERs, particularly battery storage and microgrids, as potential “non-wires solutions” to distribution system issues, Proudlove said.

NCCETC’s update highlighted Q3 policy actions aimed at clarifying the role of energy storage. Right now, energy storage policy is complicated by two conundrums. The first is whether energy storage is generation, load, or both. With a modern grid’s dynamic capabilities, storage can do both to benefit customers and the system. Without grid modernization, batteries’ two-way energy flow is a threat to stability.

The second conundrum is how to value the many benefits of storage as load and generation. A power market enabled by grid modernization could value storage’s many and unique capabilities and compensate them.

Oregon’s SB 978 put a grid modernization investigation in motion. It directs state regulators to “investigate the impact of developing industry trends, technologies, and policy drivers on the existing regulatory system and utility incentives.”

Steve Corson, the spokesperson for Portland General Electric (PGE), emailed Utility Dive that customer demand for decarbonizing the Oregon grid is driving PGE’s commitment to grid modernization. The utility completed its AMI deployment in 2010 and its recent investment in wireless spectrum “will make it easier to upgrade to smarter technologies,” Corson said.

PGE also recently asked the Oregon Public Utility Commission to approve an almost 39 MW buildout of storage at multiple sites, including customer-based sites intended to support other DER, Corson added.

Grid modernization will enable “a flexible, two-way grid,” Corson said. The result will be a “more complex” system that is “more resilient, cleaner, and responsive to customer needs.”

But with the changing regulatory framework and grid modernization, “we need to maintain the positive elements of the regulated business model to assure equitable, affordable and universal electric service,” he said.

Proudlove sees another emerging trend in legislation in Washington, New Mexico, and California during Q3 that would require utilities to consider storage-as-a-solution in their IRPs.

California’s Senate Bill 338 requires utilities to consider how carbon-free resources can meet peak power needs in their IRPs. State Sen. Nancy Skinner (D), the bill’s author, told Utility Dive the increasing cost-effectiveness of storage and DER and the increasing challenges of the state’s dynamic load make storage a timely choice.

Energy Storage Association (ESA) Policy and Advocacy Director Jason Burwen told Utility Dive a push for IRP rule changes followed the failure of utilities to respond to offerings by storage providers in procurement bidding. Including storage in IRPs “will lead to a full consideration of evidence of its potential,” he said.

The New Mexico commission changed state IRP rules to require the evaluation of energy storage separately from other demand-side resources. Within weeks of the rule change, Public Service of New Mexico (PNM), the state’s dominant electricity provider, issued a public solicitation for new capacity.

“PNM is encouraging renewable and battery storage options beyond those identified in the 2017 IRP,” the request for bids on 456 MW of capacity stated. Burwen said he could not recall “a capacity request for proposals in which a utility explicitly asked for storage bids.”

Even so, both Proudlove and Burwen agreed the Washington state commission’s changes to utility IRP rules was the most important yet.

It specifically asks how “the growth of distributed generation and development of energy storage technologies should be treated in the IRP,” NCCETC reported.

And it includes detailed recommendations on how to study and value storage, Burwen said.

There is one completely unprecedented innovation in the commission’s order, Burwen said. It says that “utilities must be able to demonstrate in any prudence determination for a new resource acquisition that their analysis of resource options included a storage alternative.”

That statement represents “the first time a commission has required consideration of storage as part of a prudency determination,” Burwen said. It tells the state’s vertically integrated utilities that “getting cost recovery requires a serious consideration of storage.”

Washington state electric provider Avista Utilities spokesperson Debbie Simock said the commission’s order aligns with Avista’s 2017 IRP. It shows that “significantly lower” energy storage costs now make it “operationally attractive,” she said. The utility’s next IRP will examine how much storage will benefit Avista’s system as energy and capacity.

Beyond the West Coast, AEP Texas’s challenge to state regulators to solve the load or generation conundrum for storage could also set precedents.

The utility asked for approval of a 1 MW battery and a 0.5 MW battery as “non-wires solutions” for its distribution system. It also requested approval of cost recovery for the pilot project expenditures.

The requests tested whether ownership and operation of batteries by a regulated transmission and distribution (T&D) utility represents competition with Texas retail electricity providers (REPs).

Proudlove said the decision could be significant for other utilities in Texas. Sierra Club Lone Star Chapter Conservation Director Cyrus Reed agreed.

Opposition from REPs and generators was not because of the market impact of the two small batteries, Reed told Utility Dive. It was because other T&D utilities may request cost recovery for “bigger battery facilities” that would be “real competition” for REPs and generators.

A PUCT administrative law judge (ALJ) decided in AEP’s favor, finding “no statutory or regulatory prohibitions.” But the proceeding raised questions of policy, the decision concluded. Therefore, it limited any precedential value by recommending “the Commission limit its approval to this Application.” The commission’s order is expected in December.

ESA’s Burwen said these policy actions “show there are forward thinking utility commissions and utilities working to meet public policy goals and protect ratepayers.” The high number of actions is because “the world is changing, technology is changing, and the capabilities available to grid operators, especially with energy storage, are changing very quickly.”

Source:

https://www.utilitydive.com/news/as-feds-focus-on-baseload-grid-modernization-is-sweeping-the-nation/510680/